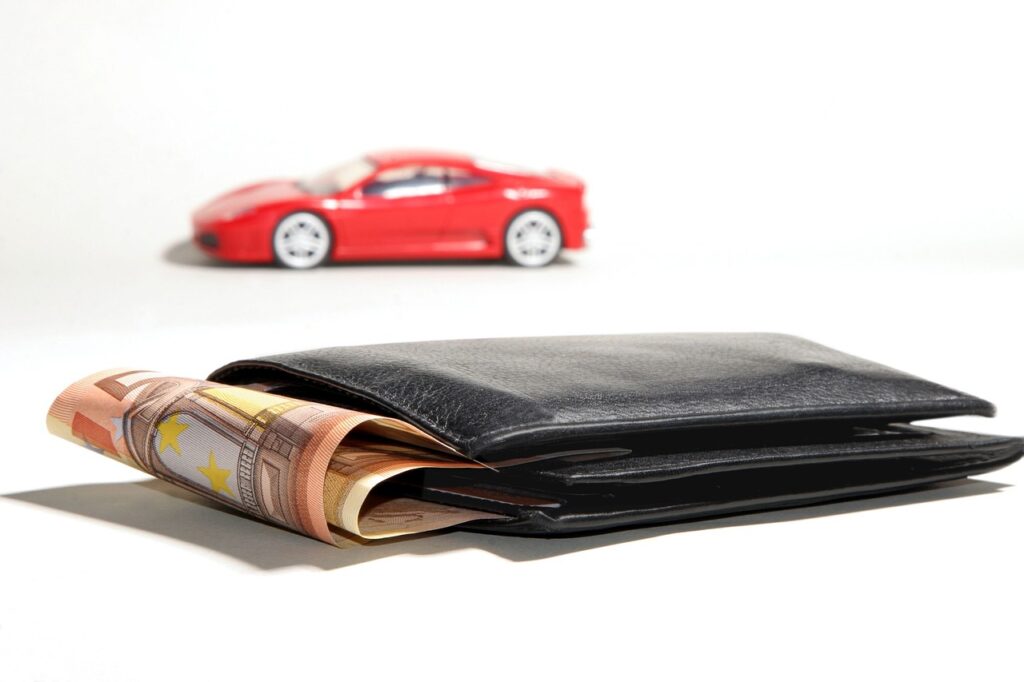

Navigating the financial labyrinth can be tricky, especially when you need quick cash. The good news is that if you own a car, it could be your ticket to the funds you need. But where can I get a loan using my car as collateral?

Buckle up because we’re about to embark on a humorous yet informative ride through the world of car title loans, exploring the options, the pitfalls, and the frequently asked questions that come with them.

What is a Car Title Loan?

Before we answer the burning question, “where can I get a loan using my car as collateral?” let’s break down what a car title loan actually is. A car title loan, also known as an auto title loan, is a secured loan where borrowers can use their vehicle title as collateral.

Borrowers who get approved for such loans must allow the lender to place a lien on their car title and temporarily surrender the hard copy of their vehicle title in exchange for loan funds.

Why Consider a Car Title Loan?

If you’re wondering why you should even think about a car title loan, consider the following scenarios: unexpected medical bills, a sudden home repair, or a much-needed vacation (we all deserve a break, right?).

These loans can provide quick access to cash without a lengthy approval process. But remember, with great power comes great responsibility.

Where Can I Get a Loan Using My Car as Collateral?

So, where can I get a loan using my car as collateral? There are several avenues to explore, each with its own pros and cons.

1. Traditional Banks and Credit Unions

Yes, even the stodgy old banks and credit unions offer car title loans. They might not advertise it with neon lights, but they do. The advantage here is the potential for lower interest rates compared to other lenders.

However, the downside is the bureaucracy. Be prepared to jump through more hoops than a circus poodle.

2. Online Lenders

The internet has revolutionized everything, including where you can get a loan using your car as collateral. Online lenders offer the convenience of applying from your couch, often with faster approval times.

Websites like TitleMax and LoanMart are popular choices. The catch? Interest rates can be higher, so it’s essential to read the fine print and understand the repayment terms.

3. Auto Title Loan Companies

Specialized auto title loan companies are a common answer to the question, “where can I get a loan using my car as collateral?” These companies focus solely on car title loans and can offer quick and easy approvals.

Think of them as the fast food of the loan world—quick and convenient, but potentially unhealthy for your financial diet if not managed properly.

4. Peer-to-Peer Lending Platforms

Peer-to-peer (P2P) lending platforms like LendingClub and Prosper offer another avenue for obtaining a loan using your car as collateral. These platforms connect borrowers with individual investors, which can sometimes result in better loan terms.

However, the process can be a bit more involved than going directly through a lender.

5. Local Pawn Shops

In a pinch, some local pawn shops might offer loans using your car as collateral. This option is typically a last resort due to high-interest rates and less favorable terms. But hey, when you’re desperate, it’s good to know all your options.

The Risks and Rewards

Before you rush off to find where you can get a loan using your car as collateral, let’s talk risks and rewards.

Rewards

- Quick Cash: Fast access to funds can be a lifesaver in emergencies.

- Easy Approval: Bad credit? No problem. Your car is the star here.

- Keep Driving: In most cases, you can keep using your car while repaying the loan.

Risks

- High-Interest Rates: These loans can come with hefty interest rates.

- Repossession: Miss a payment, and your car could be taken faster than you can say “auto loan.”

- Debt Cycle: The ease of these loans can lead to borrowing more than you can repay.

Tips for Getting a Car Title Loan

If you’re still set on finding out where you can get a loan using your car as collateral, here are some tips to make the process smoother:

- Know Your Car’s Value: The amount you can borrow depends on your car’s worth.

- Shop Around: Compare different lenders to find the best terms.

- Read the Fine Print: Understand all fees and repayment terms.

- Have a Repayment Plan: Ensure you can make the payments to avoid repossession.

Alternatives to Car Title Loans

Before you dive headfirst into the world of car title loans, consider some alternatives. After all, knowing where you can get a loan using your car as collateral is great, but so is exploring other options.

Personal Loans

Personal loans from a bank or credit union might have lower interest rates and better terms. They require good credit, but they can be a better option if you qualify.

Credit Cards

If you have a credit card with available balance, it might be a quicker and cheaper way to get the funds you need. Be wary of high-interest rates, but they’re usually lower than car title loans.

Borrowing from Friends or Family

It’s not always easy, but borrowing from loved ones can be a way to avoid high-interest loans. Just be sure to agree on repayment terms to avoid straining relationships.

The Road Ahead

So, where can I get a loan using my car as collateral? You’ve got options, and now you know the ins and outs. But remember, every financial decision comes with consequences, so weigh them carefully.

Also Read:

- Can You Get a Loan Without a Job? Here’s How!

- How Can Grants for Single Mothers Provide Financial Relief and Support?

FAQs

1. How much can I borrow with a car title loan?

The amount varies, but typically you can borrow between 25% to 50% of your car’s value.

2. How quickly can I get the funds?

Many lenders can provide funds within 24 hours of approval.

3. What if I have bad credit?

Car title loans are often approved regardless of credit, as the car serves as collateral.

4. Can I keep my car while repaying the loan?

Yes, in most cases, you can continue using your car while making payments.

5. What happens if I miss a payment?

Missing payments can lead to repossession of your vehicle.

6. Are there any hidden fees?

Always read the fine print. Some lenders may have hidden fees, so it’s crucial to understand all costs involved.

7. Can I repay the loan early?

Some lenders allow early repayment without penalties, but confirm this before signing.

So, now that you know where you can get a loan using your car as collateral, you’re better equipped to make an informed decision.

Whether you opt for a traditional bank, an online lender, or a specialized auto title loan company, remember to consider all the pros and cons. Safe travels on your financial journey!