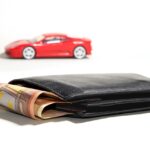

Imagine waking up to find that your car won’t start, and you need to get to work. Or maybe an unexpected medical bill lands in your mailbox, and payday is still a week away. Financial emergencies can strike at any time, and sometimes, traditional lending options just aren’t fast enough.

This is where same day loans without proof of income come into play, offering a lifeline for those in need of immediate funds. In this engaging guide, we’ll explore the ins and outs of these loans, peppered with a dash of humor to keep things light.

The Rise of Same Day Loans Without Proof of Income

In today’s fast-paced world, waiting for a loan approval can feel like watching paint dry. With the rise of same day loans without proof of income, the lending landscape has evolved to meet the needs of individuals who require swift access to cash.

These loans cater to people who, for various reasons, might not have immediate proof of income but still need financial assistance.

Why the sudden surge in popularity? It’s simple. Traditional loans often require extensive documentation, including proof of income, which can be a hurdle for freelancers, gig workers, or those between jobs.

Same day loans without proof of income offer a convenient alternative, providing quick access to funds without the bureaucratic red tape.

What Are Same Day Loans Without Proof of Income?

Before diving into the specifics, let’s clarify what same day loans without proof of income actually are. These are short-term loans designed to provide immediate financial relief, typically without the need for traditional income verification.

They can come in various forms, including payday loans, personal loans, and cash advances.

Types of Same Day Loans Without Proof of Income

When it comes to same day loans without proof of income, there are several options to consider. Each type of loan has its own benefits and drawbacks, so it’s essential to choose the one that best suits your needs.

1. Payday Loans

Payday loans are one of the most common types of same day loans without proof of income. These short-term loans are designed to be repaid on your next payday.

While they offer quick access to cash, they often come with high interest rates and fees. It’s crucial to read the fine print and understand the terms before committing.

2. Personal Loans

Personal loans are another option for those seeking same day loans without proof of income. Unlike payday loans, personal loans typically offer longer repayment terms and lower interest rates. However, they may still require some form of collateral or a good credit score.

3. Cash Advances

Cash advances allow you to borrow against your next paycheck or your credit card limit. These loans are convenient and can be processed quickly, but they also come with high fees and interest rates.

It’s important to use cash advances sparingly and ensure you can repay them on time.

Applying for Same Day Loans Without Proof of Income

Applying for same day loans without proof of income is a relatively straightforward process, but there are a few key steps you should follow to ensure a smooth experience.

1. Assess Your Financial Situation

Before applying for a loan, take a close look at your financial situation. Determine how much you need to borrow and how quickly you can repay it. Be realistic about your budget to avoid overextending yourself and falling into a cycle of debt.

2. Research Lenders

Not all lenders are created equal, so it’s crucial to do your research. Compare interest rates, fees, and repayment terms from various lenders to find the best deal. Look for reputable lenders who specialize in same day loans without proof of income.

3. Gather Documentation

While these loans typically don’t require proof of income, you may still need to provide other documentation, such as identification, bank statements, and details about your employment status. Having all your paperwork in order can speed up the application process.

4. Submit Your Application

Once you’ve chosen a lender and gathered your documentation, it’s time to submit your application. Be sure to fill out the application accurately and completely to avoid any delays. If you’re approved, the lender will provide you with the loan terms and conditions.

Top Tips for Managing Same Day Loans Without Proof of Income

Securing a same day loan without proof of income is just the beginning. Here are some top tips to help you manage your loan effectively.

1. Borrow Only What You Need

It can be tempting to borrow more than you need, especially if a lender offers a higher loan amount. However, it’s important to borrow only what you need to cover your immediate expenses. This will help you avoid unnecessary debt and make repayment more manageable.

2. Create a Repayment Plan

Once you’ve secured your loan, create a repayment plan to ensure you can repay it on time. Consider setting up automatic payments to avoid missing due dates and incurring additional fees.

3. Avoid Taking Multiple Loans

Taking out multiple same day loans without proof of income can quickly lead to a cycle of debt. If you find yourself needing to borrow again, reassess your financial situation and consider other options before taking on additional loans.

4. Communicate with Your Lender

If you’re having trouble repaying your loan, communicate with your lender as soon as possible. Many lenders are willing to work with borrowers to create a more manageable repayment plan. Ignoring the issue will only lead to more stress and financial trouble.

The Benefits of Same Day Loans Without Proof of Income

Same day loans without proof of income offer numerous benefits, making them an attractive option for many individuals.

1. Quick Access to Funds

One of the most significant advantages of same day loans without proof of income is the quick access to funds. These loans are designed to provide immediate financial relief, often within hours of approval.

2. No Need for Traditional Income Verification

For freelancers, gig workers, and those between jobs, providing traditional proof of income can be challenging. Same day loans without proof of income eliminate this requirement, making it easier to secure the funds you need.

3. Flexible Use of Funds

Same day loans without proof of income can be used for a variety of purposes, from covering unexpected medical bills to repairing a broken-down car. This flexibility makes them a versatile option for managing financial emergencies.

4. Simple Application Process

The application process for same day loans without proof of income is typically straightforward and quick. Many lenders offer online applications, allowing you to apply from the comfort of your home and receive a decision within minutes.

Understanding the Risks

While same day loans without proof of income offer numerous benefits, it’s important to understand the risks involved.

1. High Interest Rates and Fees

These loans often come with high interest rates and fees, making them an expensive option. It’s crucial to read the fine print and understand the total cost of the loan before committing.

2. Potential for Debt Cycle

The convenience of same day loans without proof of income can sometimes lead to a cycle of debt. Borrowers may find themselves taking out additional loans to repay previous ones, leading to financial instability.

3. Impact on Credit Score

Failure to repay your loan on time can negatively impact your credit score, making it more challenging to secure future loans. It’s important to create a realistic repayment plan and stick to it.

Same Day Loans Without Proof of Income: The Final Word

Same day loans without proof of income can be a lifesaver in financial emergencies, offering quick and convenient access to funds. However, it’s important to approach them with caution.

By understanding the benefits and risks, carefully managing your loan, and planning for repayment, you can navigate the world of same day loans without proof of income effectively and responsibly.

So, the next time you find yourself in a financial pinch, remember that help is just a loan application away—just be sure to read the fine print!

Also Read:

- How Can Grants for Single Mothers Provide Financial Relief and Support?

- Navigating Same Day Emergency Loans: Quick Cash When You Need It Most

FAQ: Same Day Loans Without Proof of Income

What are same day loans without proof of income?

Same day loans without proof of income are short-term loans designed to provide immediate financial relief without the need for traditional income verification. They can come in the form of payday loans, personal loans, and cash advances.

How do I apply for a same day loan without proof of income?

To apply for a same day loan without proof of income, assess your financial situation, research lenders, gather necessary documentation, and submit your application. Ensure you compare interest rates, fees, and terms to find the best deal.

Are there any risks associated with same day loans without proof of income?

Yes, these loans often come with high interest rates and fees, and there is a potential for falling into a cycle of debt. It’s important to understand the terms and create a realistic repayment plan.

What are the benefits of same day loans without proof of income?

Benefits include quick access to funds, no need for traditional income verification, flexible use of funds, and a simple application process. These loans can provide immediate financial relief in emergencies.

Can I take out multiple same day loans without proof of income?

While it’s possible to take out multiple loans, it’s generally not recommended as it can lead to a cycle of debt. Reassess your financial situation and consider other options before taking on additional loans.

What should I consider before taking out a same day loan without proof of income?

Consider borrowing only what you need, creating a repayment plan, avoiding multiple loans, and communicating with your lender if you encounter repayment difficulties. Understanding the terms and risks involved is crucial.